The Indian real estate sector is one of the most globally recognized sectors. It is the second largest employer after agriculture and is slated to grow at 30% over the next decade. The real estate sector comprises of five subsectors – housing, retail, hospitality, industrial and office. The growth of this sector is well complemented by the growth of the corporate environment and the demand for office space as well as urban and semi-urban accommodations.

The construction industry ranks third amongst the 14 major sectors in terms of direct, indirect and induced effects on the economy.

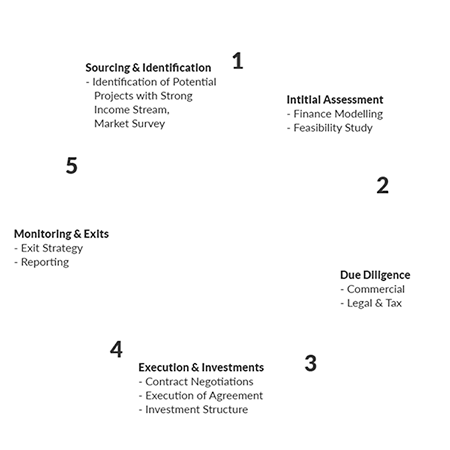

The Fund intends to primarily focus on investments in the commercial asset class and residential asset class to take advantage of residential and commercial real estate growth in India. In order to achieve the Fund’s objective of superior consistent risk-adjusted returns the Fund shall be however open to make investments across all real estate asset classes. All the investment decisions shall be made after a careful evaluation of the risk and returns of the project.